How Interest Rates Are Effecting our Market

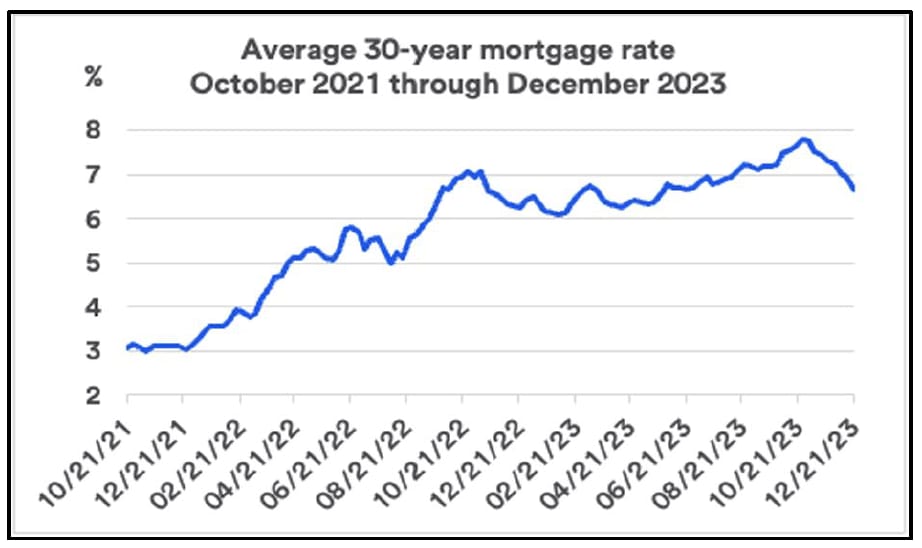

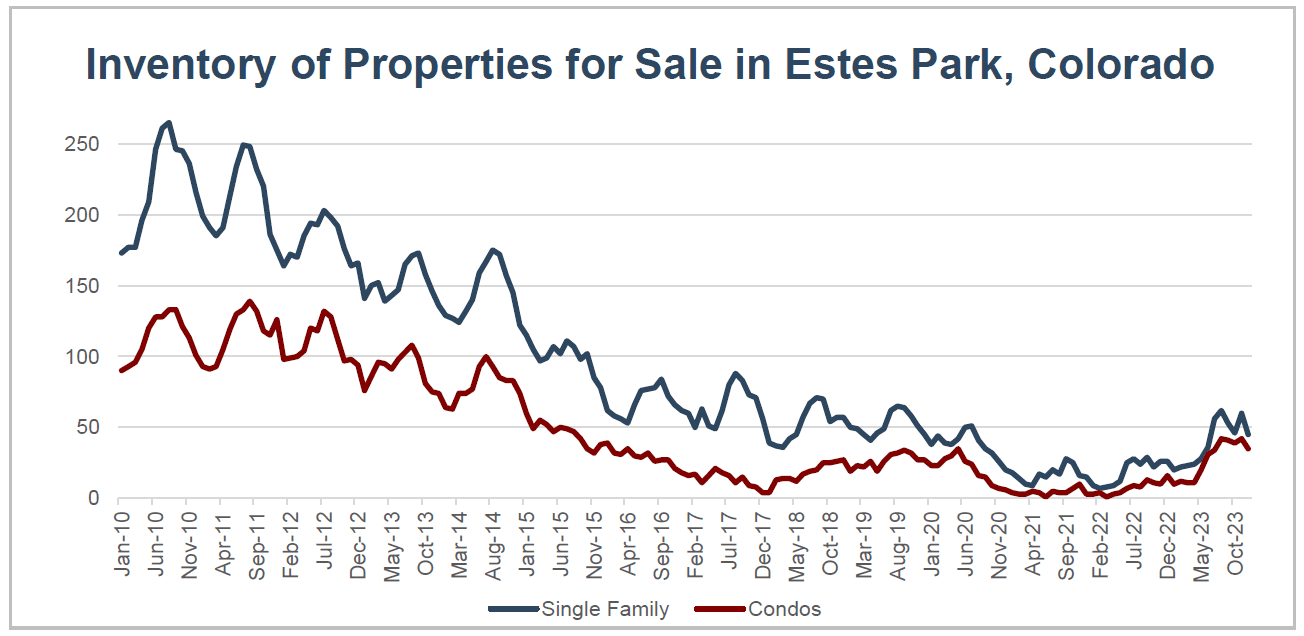

The two biggest stories of 2023 revolve around mortgage interest rates and available inventory for sale. More specifically, the fast-rising interest rates stalled out buyers from purchasing in the last half of 2023. In addition, sellers have been reluctant to give up their mortgage rates under 4% on their existing properties. These two conflicting situations have drastically changed our market from a frenetic pace over the last few years to one that is far less urgent.

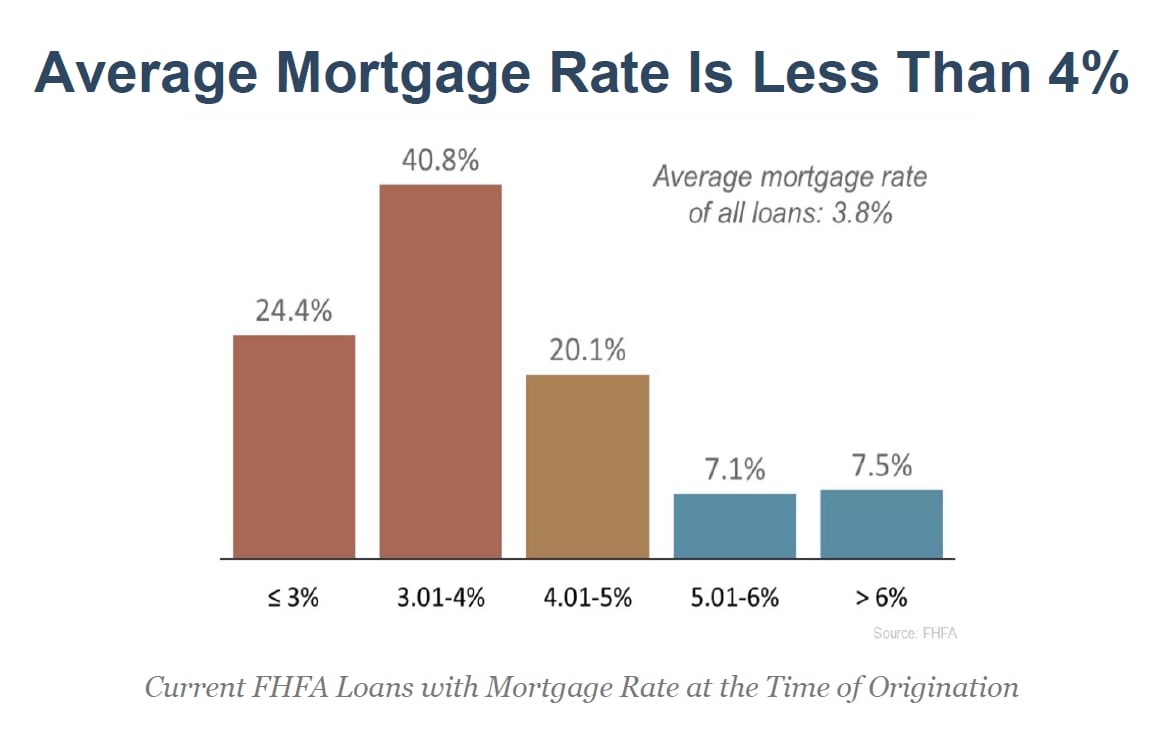

When you understand that 65.2% of homeowners have a mortgage rate of 4.0% or less, it is no wonder they don't want to consider making any moves.

The natural reaction to inflation in the economy is for mortgage interest rates to lower over time, so that is what we are expecting and just starting to see as 2024 begins. How fast those rates come back down will be anyone's guess. It would be prudent to watch how interest rates impact your buying power. It is a good idea to keep a target interest rate in mind to make sure you don't wait too long.

While you are waiting for rates to come down, it is also important to keep in mind that we still expect prices to continue to rise in the long term. Even while prices have been flat lately, the overall trend is still predicted to rise because of our low inventory....especially among properties in top condition.

Since the summer of 2022, supply and demand have undergone significant changes. Rising interest rates, driven by high inflation, have reduced demand for housing. This decrease in demand would typically lead to lower prices. However, this scenario assumes that supply (inventory) remains constant, which has not been the case. Inventory nationwide has increased but not as much as we would have expected (see graph below. The low rates homeowners are locked into with their financing are one of the biggest reasons why we haven’t seen more properties become available for sale.

The general consensus from all of the financial advisors and mortgage experts is that mortgage rates will go down in the future as we break through this inflationary environment. My expectation is that lower rates will cause higher demand for real estate. If that is the case, prices will continue to rise. There is no telling exactly how long we will be in this current lull as interest rates continue to fluctuate. But the opportunity people are holding out for might disappear behind a more expensive house in the future.

In addition, there is a huge portion of the population that also has a lot of equity in their homes and that extra equity gives people lots of options to buy a second home, an investment property, or a new primary home while they rent out the old one. Specifically, by utilizing a home equity loan or a home equity line of credit, a person can keep their original low-interest loan AND make use of the equity in their home towards new real estate goals.

It is our goal at Alpine Legacy to help you make wise real estate decisions and the best decisions blend the mix between your head and your heart, emotion and logic, or art and science. If you take action on one side of the equation, you may end up with regret. We sincerely enjoy helping people through the process of buying and selling real estate, and our market right now still has opportunities for both buyers wanting their home in the mountains as well as sellers deciding when to sell. We would love to connect with you to Help You Make a Wise Real Estate Decision.